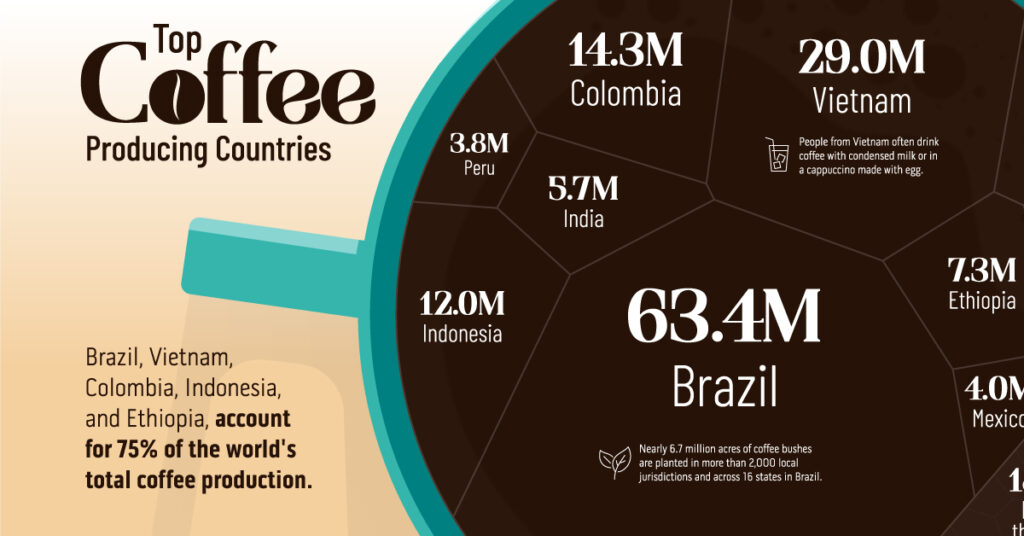

Colombia is a powerhouse in the coffee industry. Known for its high-quality Arabica beans, the country has built a reputation for producing some of the best coffee in the world. But beyond its rich flavours and aromas, Colombian coffee export statistics play a major role in international trade and the country’s economy.

What are the top destinations for Colombian coffee exports?

In 2025, the top markets for Colombian coffee are the U.S. (40%), Belgium, Germany, Canada, and Japan.

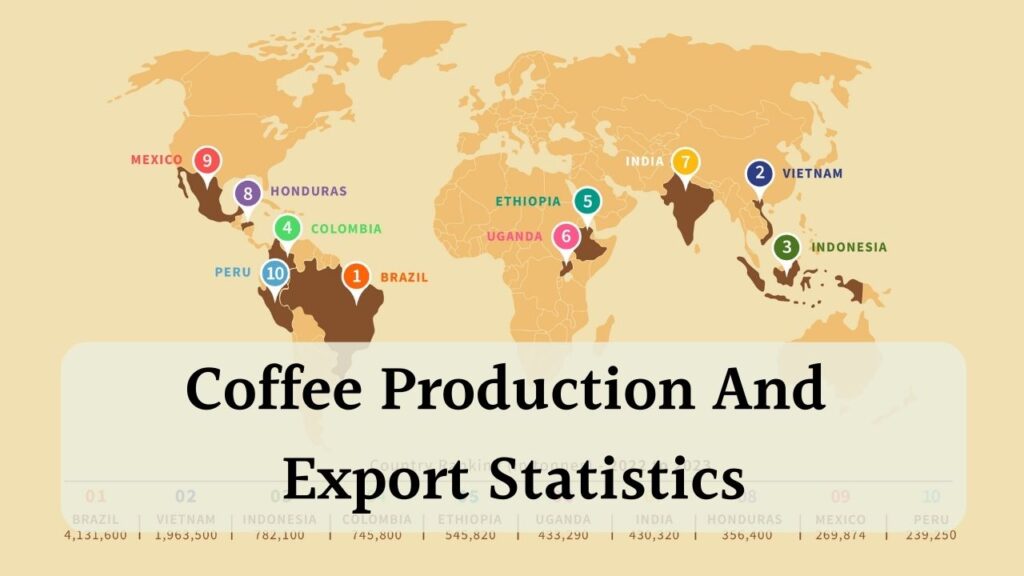

Colombia has consistently ranked as one of the largest coffee exporters, standing strong alongside Brazil and Vietnam. However, recent years have seen fluctuations in export volume, with climate factors, economic shifts, and trade regulations influencing production and sales.

In 2023, Colombia exported approximately 10.58 million bags of coffee, marking a 7% decline from the previous year. However, 2025 forecasts predict a 2% recovery, bringing exports up to 12.1 million bags.

This report covers:

✔️ Colombian coffee exports from 2012 to 2023

✔️ Key trade statistics and market trends

✔️ The impact of La Niña and economic shifts

✔️ 2025 forecasts and future innovations

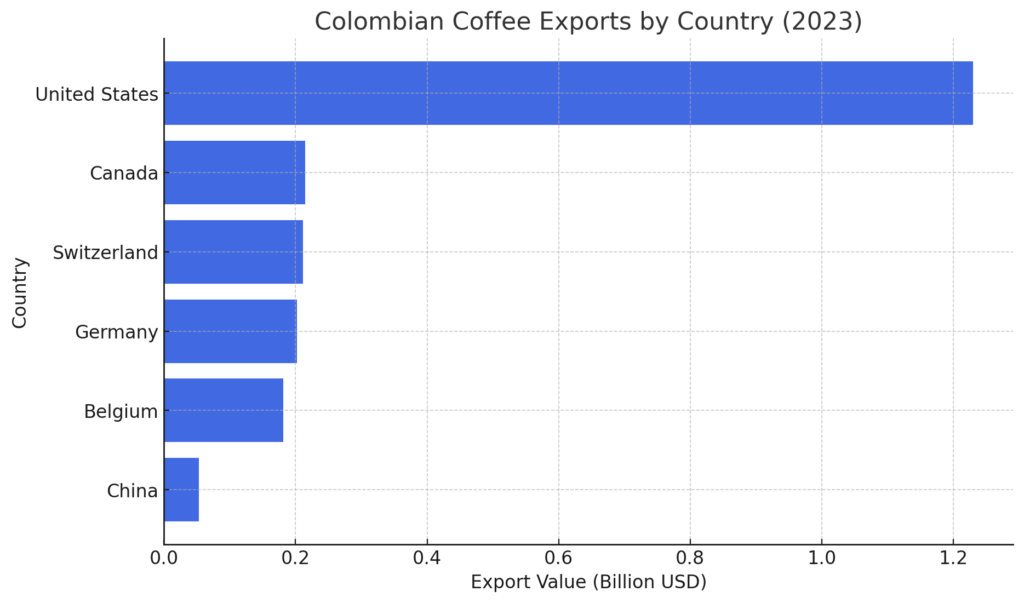

Annual Trade Data by Country

Colombia’s coffee exports play a crucial role in the global coffee market, with key trade partners shaping the industry’s performance each year. In 2023, Colombia exported $3.19 billion worth of coffee, reflecting a 28% decline from 2022, when exports reached $4.12 billion.

Top Importing Countries (2023)

Total Export Value: $3.19 billion

- 🇺🇸 United States → $1.23 billion (40% of total exports)

- 🇨🇦 Canada → $215 million

- 🇨🇭 Switzerland → $211 million

- 🇩🇪 Germany → $202 million

- 🇧🇪 Belgium → $181 million

- 🇨🇳 China → $52.7 million (62.1% increase from 2022)

Export Volume by Product (2023)

- Unroasted, Non-Decaffeinated Coffee → 575.8 million kg

- Roasted, Decaffeinated Coffee → 73,565 kg

- 🇺🇸 U.S. imported 64,936 kg ($572,750 value)

Trade Trends (2022-2023):

China’s imports surged by 62.1%, indicating growing demand for Colombian coffee in Asia.

U.S. imports fell by 32.8%, and Canada’s declined by 34.4%, reflecting shifting trade patterns.

While the U.S. remains Colombia’s largest coffee buyer, China’s rapid growth as an importer suggests new opportunities for Colombian coffee exporters in the Asian market.

The Evolution of Colombian Coffee Export Statistics (2012-2023)

Colombia’s coffee export volume has seen ups and downs over the past decade. While the country remains a major player in the international trade of coffee, factors like climate shifts, global demand, and production costs have influenced its growth.

Colombian Coffee Export Volume (2012-2023)

| Year | Export Volume (Million Bags) | Growth Rate (%) |

|---|---|---|

| 2012 | 8.5M | — |

| 2015 | 12.3M | +44.7% |

| 2018 | 13.6M | +10.5% |

| 2020 | 12.5M | -8.1% |

| 2023 | 10.58M | -7.5% |

| 2025 (Forecast) | 12.1M | +2% Recovery Expected |

Key Trends in Colombian Coffee Exports

✔️ 2012-2018 Growth → Higher global demand and improved crop yields.

✔️ 2020-2023 Decline → La Niña impact on crops, rising production costs, and trade disruptions.

✔️ 2025 Forecast → A slow but steady recovery, driven by better weather conditions and sustainability efforts.

Colombia’s coffee industry has proven resilient despite challenges. With rising demand for specialty coffee and fair-trade products, the country is well-positioned for a comeback in 2025.

Colombian Coffee in International Trade

Colombia plays a key role in the global coffee market, with its Arabica beans exported to major destinations worldwide. While the U.S. remains the top importer, demand is also growing in Europe and Asia.

Top Markets for Colombian Coffee Exports (2025)

Where does Colombian coffee go?

✔️ United States (40%) – Largest importer, driven by demand for specialty coffee.

✔️ Belgium & Germany – Key European trade hubs for coffee distribution.

✔️ Canada & Japan – Growing markets for high-quality Colombian Arabica.

Why Colombian Coffee Dominates International Trade

✔️ 100% Arabica Beans → Higher quality and premium pricing.

✔️ Sustainability Certifications → Fair-trade and organic coffee gaining traction.

✔️ Blockchain Traceability → Ensuring transparency in the coffee supply chain.

✔️ Direct-to-Consumer Growth → Expanding online coffee sales globally.

With international trade evolving, Colombia’s exports remain strong, especially in specialty and ethically sourced coffee.

The Economic Impact of Colombian Coffee Exports

Colombia’s coffee industry is a major driver of its economy, contributing significantly to agricultural GDP and international trade. Despite recent export fluctuations, coffee remains one of the country’s most valuable exports.

Key Economic Figures

✔️ $3.19 billion → Total Colombian coffee export value in 2023.

✔️ $1.23 billion → Coffee exports to theUnited States, Colombia’s biggest trade partner.

✔️ 16% of agricultural GDP → Coffee’s contribution to Colombia’sfarming sector.

How Coffee Exports Shape Colombia’s Economy

✔️ Job Creation → Millions of Colombians rely on coffee farming, production, and export logistics.

✔️ Foreign Exchange Earnings → Coffee exports bring in billions, boosting the national economy.

✔️ Global Trade Relationships → Strengthening partnerships with Europe, North America, and Asia.

Export Growth Over Time (Chart Suggestion)

A visual chart comparing coffee export values from 2012 to 2025 could showcase the growth trends and economic impact over time. Despite recent declines, 2025 forecasts suggest a moderate recovery, keeping coffee a key player in Colombia’s economic future.

Challenges Facing Colombian Coffee Producers

Despite its strong position in international trade, Colombia’s coffee industry faces several challenges. From climate change to rising production costs, these factors impact coffee exports, prices, and farmer livelihoods.

1. Climate Change & Weather Disruptions

- La Niña Impact → Heavy rainfall and temperature fluctuations have reduced coffee production in recent years.

- Changing Growing Conditions → Farmers are struggling withunpredictable weather patterns, affecting crop yields.

2. Geopolitical & Trade Tariffs

- 2025 U.S.-Colombia Tariff Dispute → Temporary trade tensions caused Arabica coffee prices to spike to $3.56 per pound, the highest since 1977.

- Economic Instability in Europe → Inflation and changing consumer habits may lower Colombian coffee imports.

3. Rising Costs for Coffee Farmers

- Higher Labor & Fertilizer Costs → Reducing profit margins for small-scale coffee growers.

- Supply Chain Issues → Global shipping disruptions have increased export costs.

How Colombia is Adapting

✔️ Climate-Resilient Crops → Farmers are investing in drought-resistant coffee varieties.

✔️ Blockchain Traceability → Improving transparency in coffee supply chains.

✔️ Government Support → The FNC (Federación Nacional de Cafeteros) is introducing initiatives to help farmers navigate market fluctuations.

Despite these hurdles, Colombia remains one of the top coffee exporters, adapting to new challenges through innovation and sustainable farming.

Future Trends: What’s Next for Colombian Coffee?

As the coffee market evolves, Colombia’s exports are set for a comeback. 2025 forecasts predict a 2% increase in export volume, driven by innovation, sustainability, and global demand for specialty coffee.

1. 2025 Coffee Production & Export Forecasts

- 11.6 million bags → Expected Colombian coffee production, a 3% increase from 2024.

- 12.1 million bags → Projected coffee export volume, showing a 2% recovery.

2. Growth of Specialty & Direct-to-Consumer Coffee

- Fair-trade, organic, and micro-lot coffee are in high demand.

- Online coffee sales are growing, cutting out middlemen and increasing profits for farmers.

3. AI & Blockchain in Coffee Trade

- AI-driven climate monitoring is helping farmers optimize coffee production.

- Blockchain traceability is improving transparency and trust in Colombia’s coffee exports.

4. Shifting Consumer Preferences

- Ethical sourcing is key → Consumers are demandingsustainable and traceable coffee.

- Premium Arabica beans are gaining traction in Europe, Asia, and North America.

With new technology, better trade strategies, and sustainable farming, Colombia is positioning itself for long-term success in the global coffee market.

Conclusion

Colombia’s coffee exports continue to be a dominant force in the global coffee market, despite facing challenges in recent years. While 2023 saw a 7% decline in export volume, 2025 forecasts predict a recovery, supported by improved weather conditions, sustainability efforts, and evolving trade strategies.

As the third-largest coffee exporter, Colombia remains a key supplier of high-quality Arabica beans, with the U.S. accounting for 40% of its exports. Demand is also rising across Europe and Asia, especially for specialty and ethically sourced coffee. The future of Colombian coffee exports is being shaped by sustainability initiatives, blockchain traceability, and AI-driven innovations, allowing for greater transparency and efficiency in the industry. Direct-to-consumer sales and the growing specialty coffee market are also expected to drive new opportunities for Colombian producers.

How do you see Colombia’s coffee exports evolving over the next five years? Share your thoughts in the comments!

For more insights into the global coffee trade, sustainability trends, and market forecasts, subscribe to our newsletter and stay ahead of the latest developments in the coffee industry.